FICO Fact Sheet

Breakdown

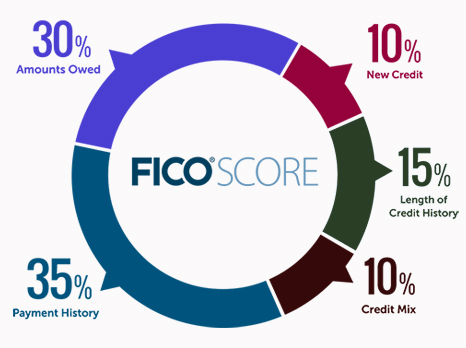

Calculating Your FICO Score

30% of the FICO Credit Score is based on Amounts Owed. This is calculated from:

- Total Credit Limit

- Total Amount Owed

- A good rule of thumb, keep balances below 25% of available credit

35% of the FICO Credit Score is based on Payment History. This is calculated from your ability to pay everything on time!

10% of the FICO Credit Score is based on New Credit. This is calculated from the number of new accounts/inquiries in a 12 month period.

15% of the FICO Credit Score is based on Length of Credit History. This is calculated from:

- Age of Oldest Account

- Age of Newest Account

- Average Age of all Accounts

10% of the FICO Credit Score is based on Credit Mix. This is calculated from a good mix of credit sources. An example of a good mix would be:

- 3 Credit Cards

- 1 Mortgage

- 1 Car Loan

Statistics

(Yes... You are just a number)

850-800 Exceptional - 799-740 Very Good - 739-670 Good

699-580 Fair - 579-300 Poor

- 65% of consumers - 650 and above

- 53% of consumers - 700 and above

- 38% of consumers - 750 and above

- National Median Score - 711

- PA Median Score - 728-737

- MSDFCU Premium Pricing 740 and above